Single Touch Payroll (STP) is the next step in streamlining Payroll reporting. It will change the way companies report their employees’ payroll information to the Australian Tax Office (ATO).

NAV Payroll clients will be required to send payroll information to the ATO via a Sending Service Provider (SSP) as part of each payroll process. The ATO calls this a Pay Event. This includes payments such as salaries and wages, pay as you go (PAYG) withholding, and superannuation information.

Clients will be able to make corrections if they make a mistake. The ATO calls this an Update Event.

The new plugin to the NAV payroll which performs the STP file generation is called Payfocus.

Payroll clients must select a SSP, either Ozedi or Superchoice. These providers will validate and send the Payfocus generated STP files securely to the ATO.

- OZEDI service fees are based on data file size

- Superchoice service fees are based on per employee transaction

There are upgrade steps and setup which will need to be performed prior to creating the STP data file to be uploaded that Fenwick consultants will assist with. These steps include updating the Year to Date accumulators for Superannuation, creating Payer Declarer Identifiers for Payroll users who will be submitting the STP information, and updating the STP message structure from the ATO.

NAV Single Touch Payroll is the next step in streamlining Payroll reporting. It will change the way a company reports employees’ payroll information to the Australian Tax Office.

STP Processing

The processing of pay runs has not changed. The payroll officer just needs to perform an additional step as part of the pay run process.

Once the pay run has been completed in NAV, a Pay Event needs to be created.

Prior to the Pay Event, the STP Payment Proof List needs to be run and checked as it lists any errors that may cause the Pay Event to be rejected by the ATO. These errors will need to be corrected before generating the Pay Event.

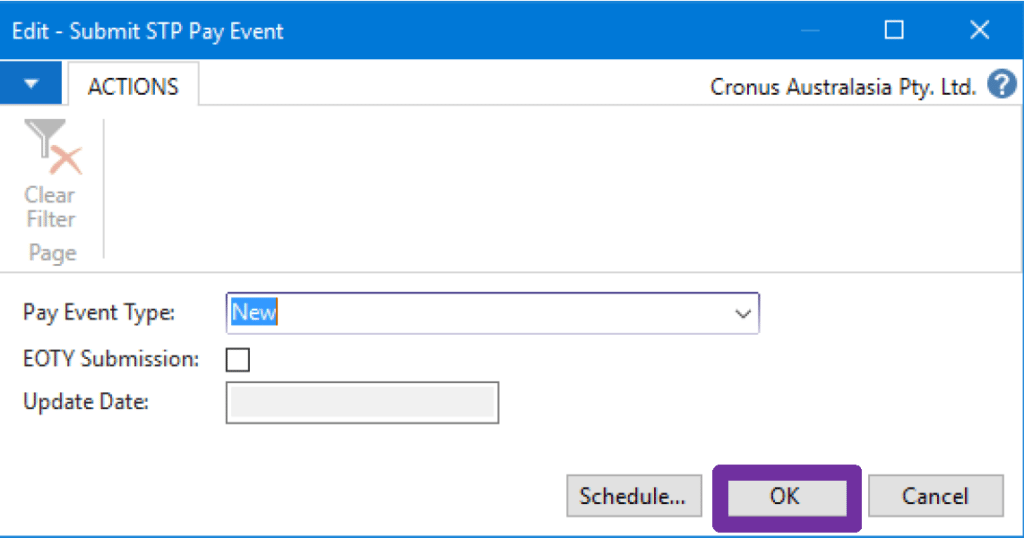

When the data is correct, the user will then create a new Pay Event by running the Submit STP Pay Event.

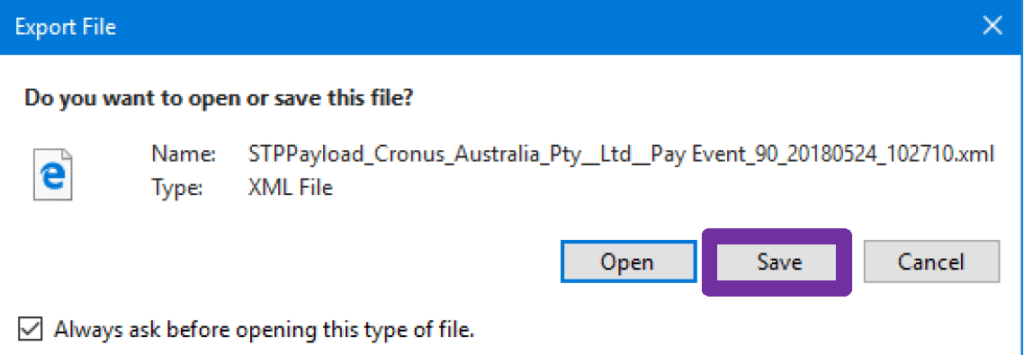

Payfocus will generate the file as shown below.

The user can then save the file to be uploaded to the SSP with the upload instructions provided by the SSP.

Using the same process, clients can also run Updates to a previous STP submission or at the end of the year, perform an End of the Year (EOTY) Submission.

Once the file has been uploaded to the SSP, the ATO will review the data and will send a response back which will either be viewable in the SSP’s portal or sent to the client via e-mail depending on which SSP you have used.

The ATO has advised that the review of the data will take up to 72 hours.

If the file is valid, there is no further action required. If it isn’t valid, the client will need to correct errors contained in the file based on the ATO’s response, e.g. Invalid e-mail address, or post code, or no Tax File Number (TFN) provided.

Payfocus provides an easy process to generate the Single Touch Payroll information required by the ATO and will be recommended for all Payroll Software clients.

In the second half of September Fenwick will start to plan the STP upgrade for each of our clients.