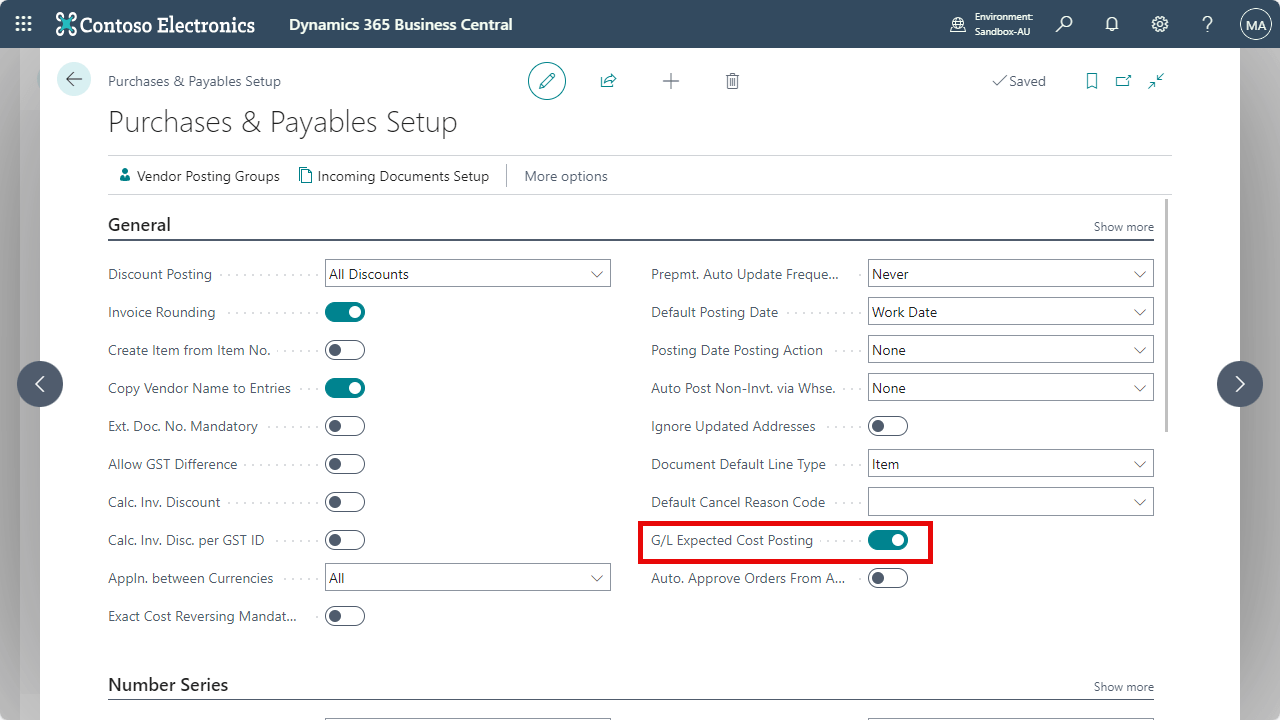

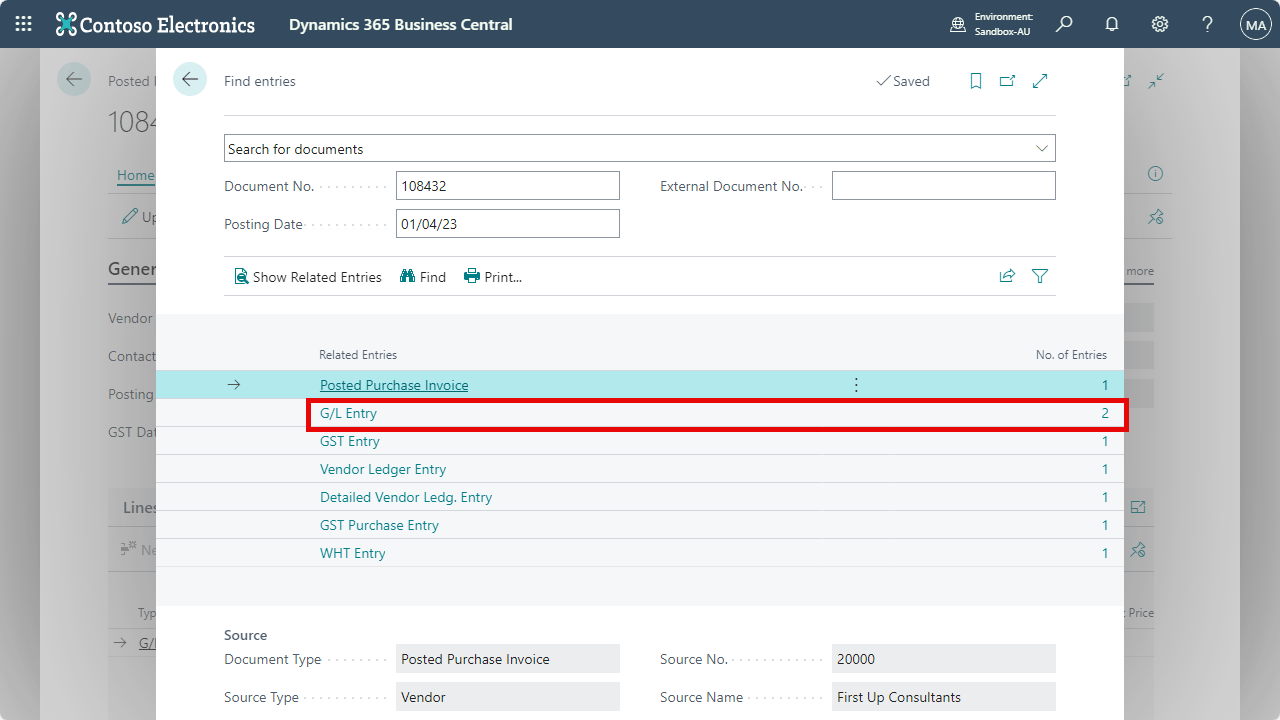

G/L Expected Cost Posting allows for accrual entries to be made at the time of receipting, removing the need for extra journals. This improvement streamlines the month-end accounting process and eliminates the need to run additional reports to identify non-inventory purchases, making period-end financial reporting more efficient and less time-consuming.

Handle Non-Inventory Purchases

G/L Expected Cost Posting extends the functionality of standard cost posting to non-inventory items and services that use a G/L account. Typically, expected cost posting and accrual processing are handled only for inventory items in standard configurations.

With the extended functionality, you can seamlessly manage the expected costs and accruals associated with non-inventory items, ensuring that these purchases are accurately recorded without requiring manual adjustments. This enhancement ensures consistency in your financial reporting for both inventory and non-inventory purchases, reducing the complexity of managing diverse procurement processes.

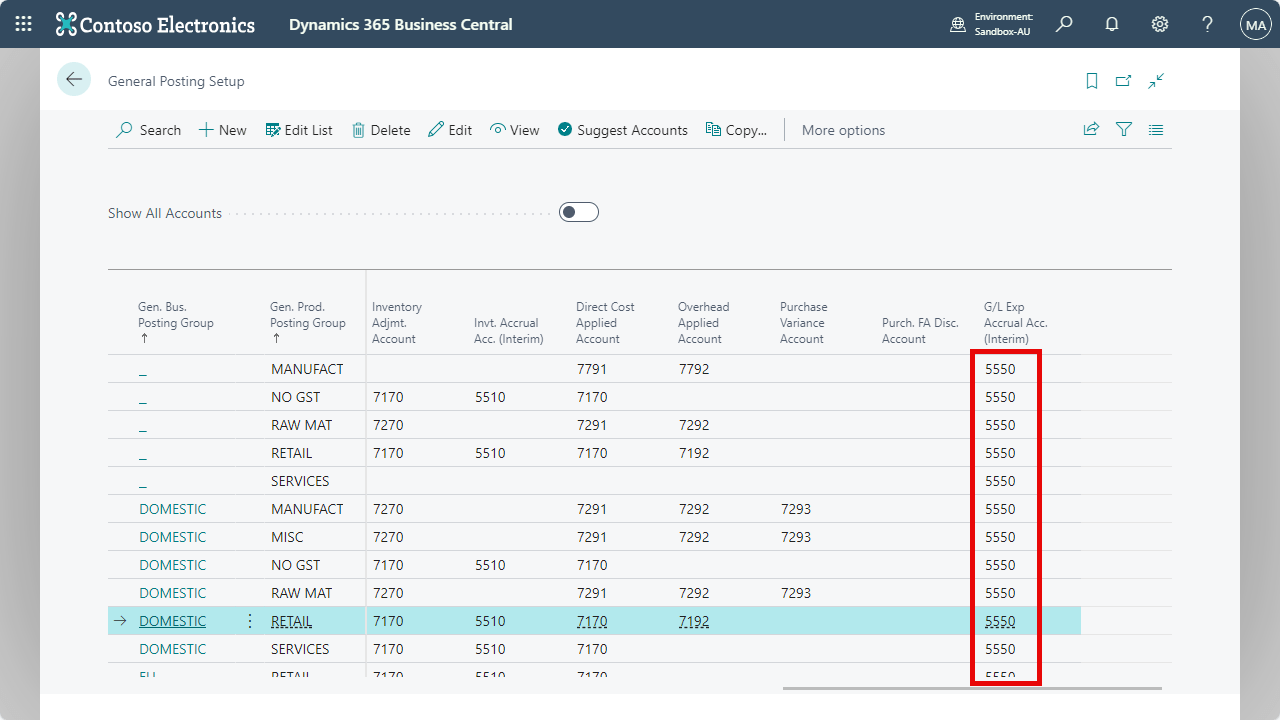

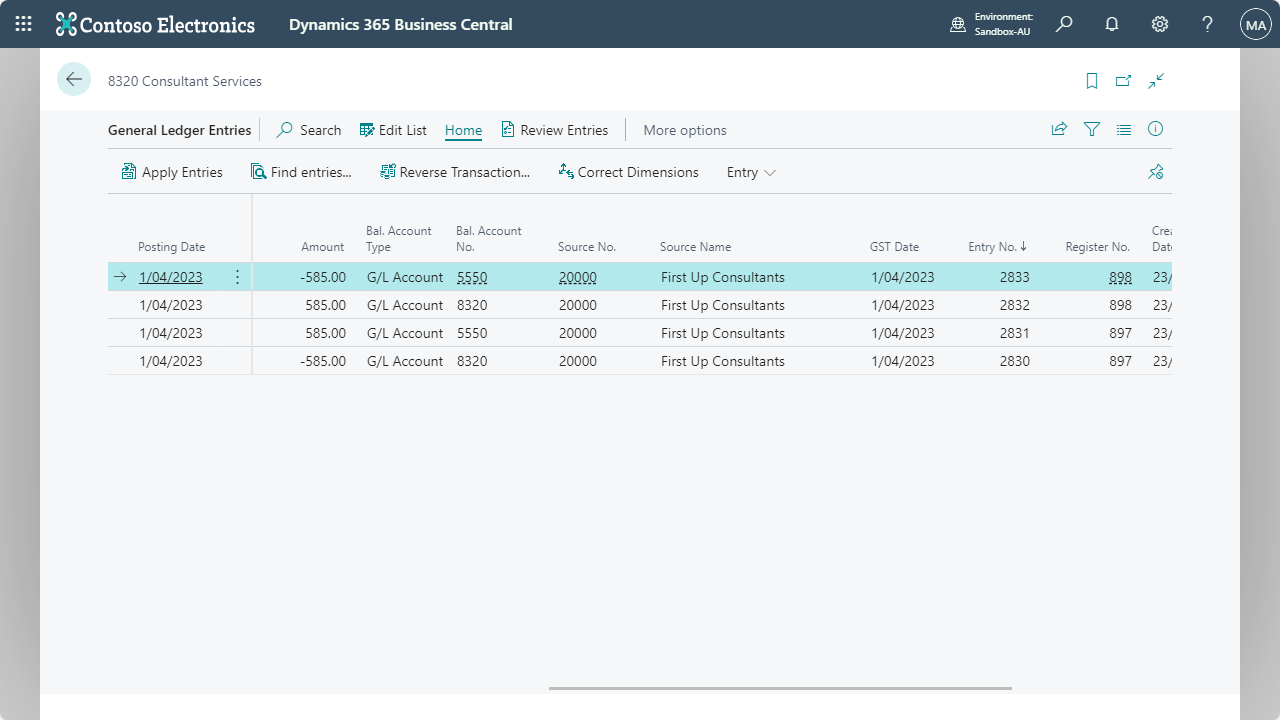

G/L Expected Cost Accrual Accounts

The G/L Expected Cost Posting app additionally allows you to automatically generate accrual entries to an accrual account at the time of receipting non-inventory purchases. This eliminates the need to create separate journal entries, further simplifying your accounting processes whilst also ensuring accurate and timely accrual posting.

The automatic creation of accrual entries directly from the receipt transaction ensures that your financial records remain up to date, eliminating delays in month-end processing and providing real-time visibility into accrued costs.

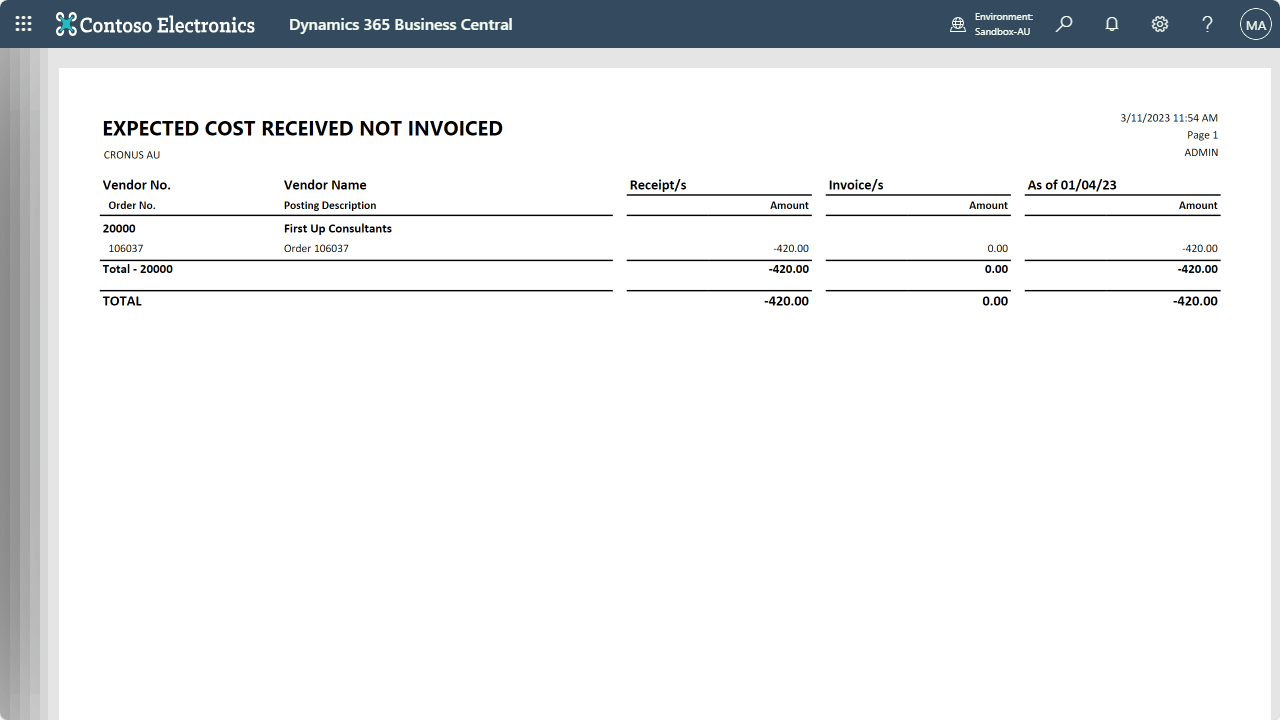

Track Expected Cost Accrual Accounts

Simplify your accounting process with the Expected Cost Received Not Invoiced report, which helps you quickly identify accrual entries for non-inventory purchases. This eliminates the need for additional reports or manual tracking, saving you time and effort.

With a more efficient approach to identifying non-inventory accruals, this report enhances the accuracy of period-end financial reporting and simplifies your month-end closing process.